- AI Platforms

Fueled by a Visual Designer, Marketplace for Reusable Connectors, ETL & ML Blocks.

Fueled by a Visual Designer, Marketplace for Reusable Connectors, ETL & ML Blocks.

Agentic AI Integrations

Integration enables agents to deliver AI outcomes faster, better, simpler.

DataNimbus FinHub

With the DataNimbus FinHub platform, we offer a whole range of escrow management.Navigate Your AI Journey

Break free from legacy! Modernize your core with intelligent, AI-powered solutions

- AI Applications

- Services

DataNimbus Consulting

- Data AI Strategy

- Data and AI Architecture

- Payment Automation

Product Engineering Services

- Product Design & UX

- Custom APIs

- AI enabled Applications

Data Analytics & AI/ML

- Data Management

- AI Applications and Models

- Custom Workflows

Enterprise Integration

- Custom API

- Process Orchestration

- Intelligent Process Orchestration Management

- Customers

- Resources

- Company

- AI Platforms

Fueled by a Visual Designer, Marketplace for Reusable Connectors, ETL & ML Blocks.

Fueled by a Visual Designer, Marketplace for Reusable Connectors, ETL & ML Blocks.

Agentic AI Integrations

Integration enables agents to deliver AI outcomes faster, better, simpler.

DataNimbus FinHub

With the DataNimbus FinHub platform, we offer a whole range of escrow management.Navigate Your AI Journey

Break free from legacy! Modernize your core with intelligent, AI-powered solutions

- AI Applications

- Services

DataNimbus Consulting

- Data AI Strategy

- Data and AI Architecture

- Payment Automation

Product Engineering Services

- Product Design & UX

- Custom APIs

- AI enabled Applications

Data Analytics & AI/ML

- Data Management

- AI Applications and Models

- Custom Workflows

Enterprise Integration

- Custom API

- Process Orchestration

- Intelligent Process Orchestration Management

- Customers

- Resources

- Company

- AI Platforms

Fueled by a Visual Designer, Marketplace for Reusable Connectors, ETL & ML Blocks.

Fueled by a Visual Designer, Marketplace for Reusable Connectors, ETL & ML Blocks.

Agentic AI Integrations

Integration enables agents to deliver AI outcomes faster, better, simpler.

DataNimbus FinHub

With the DataNimbus FinHub platform, we offer a whole range of escrow management.Navigate Your AI Journey

Break free from legacy! Modernize your core with intelligent, AI-powered solutions

- AI Applications

- Services

DataNimbus Consulting

- Data AI Strategy

- Data and AI Architecture

- Payment Automation

Product Engineering Services

- Product Design & UX

- Custom APIs

- AI enabled Applications

Data Analytics & AI/ML

- Data Management

- AI Applications and Models

- Custom Workflows

Enterprise Integration

- Custom API

- Process Orchestration

- Intelligent Process Orchestration Management

- Customers

- Resources

- Company

- AI Platforms

Fueled by a Visual Designer, Marketplace for Reusable Connectors, ETL & ML Blocks.

Fueled by a Visual Designer, Marketplace for Reusable Connectors, ETL & ML Blocks.

Agentic AI Integrations

Integration enables agents to deliver AI outcomes faster, better, simpler.

DataNimbus FinHub

With the DataNimbus FinHub platform, we offer a whole range of escrow management.Navigate Your AI Journey

Break free from legacy! Modernize your core with intelligent, AI-powered solutions

- AI Applications

- Services

DataNimbus Consulting

- Data AI Strategy

- Data and AI Architecture

- Payment Automation

Product Engineering Services

- Product Design & UX

- Custom APIs

- AI enabled Applications

Data Analytics & AI/ML

- Data Management

- AI Applications and Models

- Custom Workflows

Enterprise Integration

- Custom API

- Process Orchestration

- Intelligent Process Orchestration Management

- Customers

- Resources

- Company

Blog

Revolutionizing Collections with Real-Time B2B Payments

The Changing Landscape of B2B Payments

In today’s fast-paced business environment, traditional collection processes can no longer keep up. Real-time B2B payments are transforming how companies manage cash flow, enhance operational efficiency, and strengthen financial relationships. By enabling real-time transactions, businesses can reduce delays, improve liquidity, and gain better financial control. In this blog, we explore why real-time payments are the future of B2B transactions and how they can drive efficiency and growth.

The global shift towards digital business payments is accelerating, and businesses that fail to adapt, risk falling behind. According to industry reports, 70% of large companies have already adopted real-time payment solutions, recognizing the immense benefits they bring. As financial transactions become more instantaneous, companies must embrace real-time B2B payment methods to remain competitive and resilient.

October 2025 | Blog

Challenges with Traditional Collections

Traditional collection systems struggle with inefficiencies, that hinder business growth and lead to cash flow uncertainties The major challenges include:

Payment Delays – Bank transfers, checks, and manual approvals cause unnecessary waiting times, disrupting cash flow and business planning. Many businesses experience extended Days Sales Outstanding (DSO), making it difficult to maintain financial stability.

Manual Processes – Processing invoices, reconciling transactions, and handling disputes manually is time-consuming, error-prone, and adds to administrative burden and compliance risks.

Lack of Transparency – Businesses often struggle to track payment statuses, leading to disputes and operational bottlenecks. Without real-time insights, organizations cannot proactively address business payment discrepancies, creating further delays

High Operational Costs – Managing payment solutions manually increases administrative expenses and resource allocation. Businesses often require dedicated personnel to oversee collections, adding to overhead costs.

Compliance & Risk Management Issues – Without automated validation and audit trails, businesses risk non-compliance with financial regulations.

Why Collection and Real-time B2B Payments Automation Matter

To stay competitive, modern businesses must shift to solutions that offer speed, automation, and security. Collection and B2B payments automation offer:

- Faster Transactions – Instant payments eliminate processing delays, improving cash flow. Businesses can reduce their reliance on short-term credit and avoid financial bottlenecks.

- Better Business Relationships – Transparency and faster settlements reduce disputes and improve trust. Suppliers and vendors appreciate prompt payment processing, fostering better long-term relationships.

- Stronger Financial Control – Real-time visibility into transactions allows for better decision-making and liquidity management. Organizations can better forecast cash inflows and outflows, improving financial decisions.

- Reduced Dependency on Credit – Faster collections reduce the mean reliance on short-term credit borrowing. This, in turn, reduces the cost of borrowing and helps maintain a healthier balance sheet.

How DataNimbus FinHub Transforms Collections and B2B Payments

Traditional collection challenges demand a modern, technology-driven approach. DataNimbus’ collection and B2B payment solutions eliminate inefficiencies by enabling real-time transactions, automated reconciliation, and seamless financial tracking. With a cloud-native architecture and AI-powered automation, businesses can accelerate cash flow, reduce administrative overhead, and gain real-time financial insights—all while ensuring security and compliance. Key features include:

- Intelligent Collection Orchestration – Configurable rules allow businesses to automate collection workflows for different customer levels, ensuring smooth and efficient collections. It also supports direct collections and collect-on-behalf-of (COBO) models, providing flexibility for enterprises and financial aggregators.

- Virtual Ledger Management – Streamlines collections process by configuring multiple sub-ledgers under a single collection account, ensuring seamless tracking of payments and receivables.

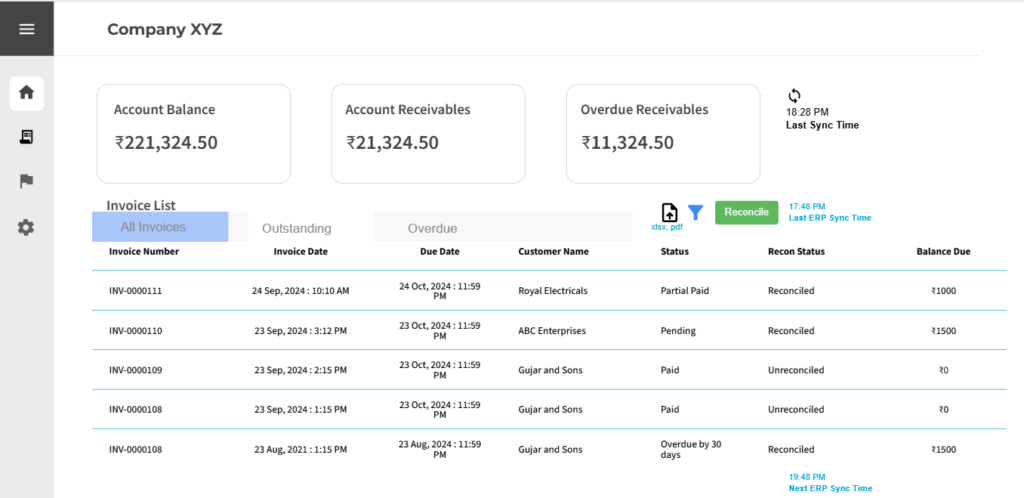

- Real-Time Reporting – Gain immediate insights into receivables and financial health through an interactive dashboard. With access to up-to-date reports, organizations can respond proactively to financial challenges.

- API Integrations – Seamless connectivity with ERP and accounting systems to automate payment processes. Real-time integration eliminates manual interventions and enhances operational efficiency.

- Secure and Compliant Transactions – Advanced encryption and fraud prevention measures safeguard payments, minimizing risks associated with cyber threats and unauthorized transactions. Automated workflows help businesses comply with regulatory and compliance mandates effortlessly.

- Automated Reconciliation – Match transactions seamlessly to invoices with AI-powered automation, ensuring real-time updates in digital ledgers. This reduces manual effort, minimizes errors, and enhances financial accuracy.

Dashboard – Real-Time Payments Solutions with Automated Reconciliation

By leveraging DataNimbus’ advanced Collections and B2B Payments, businesses can transition from outdated, inefficient collection processes to a modern, real-time system that enhances financial stability and operational agility.

Business Impact & Benefits

By adopting Collections and B2B Payments, businesses can unlock significant advantages:

Use Cases: Where Collections and B2B Payments Makes an Impact

1. Automated Invoice & Receivables Management

- Businesses can collect payments across multiple payment rails into virtual accounts, ensuring faster and seamless cash flows.

- Automated invoice-to-payment matching eliminates errors and manual intervention.

2. Smart Loan Repayment Tracking

- Lending institutions can track repayments with automated reconciliation.

- Integrated with loan management software, ensuring precision in credit settlements.

3. Credit-Based Event Processing

- AI-driven workflows identify credit inflows and trigger automatic event initiation.

- Whether it’s fund movement, reporting, or compliance tracking, businesses can streamline their processes effortlessly.

Implementing Collections and B2B Payments: Key Steps

To successfully transition to collections, businesses should:

- Choose the Right Technology Partner – Select a provider with robust security, API integrations, and instant payment & settlement capabilities. A reliable partner ensures seamless implementation and support.

- Select the Right Configuration: Define collection rules, workflows, and virtual ledger setups that align with business needs.

- Integrate with Existing Systems – Ensure seamless connectivity with ERP and financial management tools. This enhances workflow efficiency and eliminates the need for duplicate data entry.

- Ensure Security Measures – Implement fraud detection, encryption, and multi-factor authentication. Security should be a top priority to protect sensitive financial data.

- Align Internal Processes – Train teams, update policies, and optimize workflows for automation. A well-planned rollout strategy ensures smooth adoption across departments.

- Monitor and Optimize – Regularly review payment solutions performance and refine strategies for better efficiency. Continuous monitoring helps businesses identify and address potential issues.

Conclusion

The shift to collections and B2B payments is reshaping financial operations, offering businesses the ability to streamline cash flow, reduce costs, and enhance transparency. Companies that adopt instant transactions and automated processes will gain a competitive edge, ensuring financial agility and long-term stability.

As the payments business landscape evolves, companies must stay ahead by embracing modern collections and B2B payment processing technologies. DataNimbus Collections and B2B Payments offer unparalleled speed, security, and efficiency, making them an essential component of financial management. In an evolving B2B landscape, real-time Collections and Payments aren’t just an upgrade—they’re the future. Is your business ready to make the shift?