- AI Platforms

Fueled by a Visual Designer, Marketplace for Reusable Connectors, ETL & ML Blocks.

Fueled by a Visual Designer, Marketplace for Reusable Connectors, ETL & ML Blocks.

Agentic AI Integrations

Integration enables agents to deliver AI outcomes faster, better, simpler.

DataNimbus FinHub

With the DataNimbus FinHub platform, we offer a whole range of escrow management.Navigate Your AI Journey

Break free from legacy! Modernize your core with intelligent, AI-powered solutions

- AI Applications

- Services

DataNimbus Consulting

- Data AI Strategy

- Data and AI Architecture

- Payment Automation

Product Engineering Services

- Product Design & UX

- Custom APIs

- AI enabled Applications

Data Analytics & AI/ML

- Data Management

- AI Applications and Models

- Custom Workflows

Enterprise Integration

- Custom API

- Process Orchestration

- Intelligent Process Orchestration Management

- Customers

- Resources

- Company

- AI Platforms

Fueled by a Visual Designer, Marketplace for Reusable Connectors, ETL & ML Blocks.

Fueled by a Visual Designer, Marketplace for Reusable Connectors, ETL & ML Blocks.

Agentic AI Integrations

Integration enables agents to deliver AI outcomes faster, better, simpler.

DataNimbus FinHub

With the DataNimbus FinHub platform, we offer a whole range of escrow management.Navigate Your AI Journey

Break free from legacy! Modernize your core with intelligent, AI-powered solutions

- AI Applications

- Services

DataNimbus Consulting

- Data AI Strategy

- Data and AI Architecture

- Payment Automation

Product Engineering Services

- Product Design & UX

- Custom APIs

- AI enabled Applications

Data Analytics & AI/ML

- Data Management

- AI Applications and Models

- Custom Workflows

Enterprise Integration

- Custom API

- Process Orchestration

- Intelligent Process Orchestration Management

- Customers

- Resources

- Company

- AI Platforms

Fueled by a Visual Designer, Marketplace for Reusable Connectors, ETL & ML Blocks.

Fueled by a Visual Designer, Marketplace for Reusable Connectors, ETL & ML Blocks.

Agentic AI Integrations

Integration enables agents to deliver AI outcomes faster, better, simpler.

DataNimbus FinHub

With the DataNimbus FinHub platform, we offer a whole range of escrow management.Navigate Your AI Journey

Break free from legacy! Modernize your core with intelligent, AI-powered solutions

- AI Applications

- Services

DataNimbus Consulting

- Data AI Strategy

- Data and AI Architecture

- Payment Automation

Product Engineering Services

- Product Design & UX

- Custom APIs

- AI enabled Applications

Data Analytics & AI/ML

- Data Management

- AI Applications and Models

- Custom Workflows

Enterprise Integration

- Custom API

- Process Orchestration

- Intelligent Process Orchestration Management

- Customers

- Resources

- Company

- AI Platforms

Fueled by a Visual Designer, Marketplace for Reusable Connectors, ETL & ML Blocks.

Fueled by a Visual Designer, Marketplace for Reusable Connectors, ETL & ML Blocks.

Agentic AI Integrations

Integration enables agents to deliver AI outcomes faster, better, simpler.

DataNimbus FinHub

With the DataNimbus FinHub platform, we offer a whole range of escrow management.Navigate Your AI Journey

Break free from legacy! Modernize your core with intelligent, AI-powered solutions

- AI Applications

- Services

DataNimbus Consulting

- Data AI Strategy

- Data and AI Architecture

- Payment Automation

Product Engineering Services

- Product Design & UX

- Custom APIs

- AI enabled Applications

Data Analytics & AI/ML

- Data Management

- AI Applications and Models

- Custom Workflows

Enterprise Integration

- Custom API

- Process Orchestration

- Intelligent Process Orchestration Management

- Customers

- Resources

- Company

Blog

Why Sub-Accounting Is the Financial Backbone You Didn’t Know You Needed

Introduction:

And how DataNimbus FinHub Ledgers helps you automate sub-accounting, control compliance, and scale financial operations.

Today’s finance leaders oversee operations that move faster and span wider than ever before. A CFO may be tracking budgets across multiple business units, while the operations team ensures smooth payouts to vendors, manages branch-level flows, and keeps every transaction aligned with compliance.

In high-volume, high-velocity environments — from marketplaces with thousands of merchants, to lenders disbursing funds in real time, to escrows with dynamic multi-party agreements — the traditional single-account structure often limits visibility and flexibility.

What’s needed is an approach that provides granularity, programmability, and confidence at every level of financial activity.

That’s where sub-accounting comes in — serving as the foundation that gives modern organizations the clarity and control they need to scale.

October 2025 | Blog

Why Sub-Accounting Matters (More Than You Think)

Sub-accounting transforms the way you manage money by enabling

Separation of Funds

Keep obligations, use-cases, or clients financially isolated — without co-mingling funds.

Real-Time Visibility

Monitor balances at the most granular level — by merchant, borrower, milestone, or purpose.

Automated Compliance

Each sub-account can carry its own set of rules, limits, and audit trails — dramatically simplifying compliance.

Programmable Actions

Set fund movements to follow your business logic — e.g., release a payout only when a milestone is reached.

Strategic Insights

Get deep visibility into performance, utilization, and risk —insights you can’t unlock from a single consolidated account.

What Is Sub-Accounting?

Sub-accounting is the practice of creating logical partitions within a single master account — each with its own balance, purpose, and rules. Think of it as setting up dedicated “financial containers” inside your ledger: one for each project in a real estate deal, one for every merchant in a marketplace, one for each business unit in a corporate budget, or even one for every escrow condition in a settlement. This structure provides the same clarity and separation as opening multiple accounts, but without the overhead of managing them individually.

Why Traditional Systems Fall Short

Legacy ERPs and accounting platforms were designed for record-keeping, not today’s real-time, high-volume financial activity. They can tell you the balance — but they can’t define how that balance should behave.

Modern businesses need real-time visibility into transactions, the ability to manage multi-party flows, and programmable rules that adapt to evolving business models.

Traditional tools provide the foundation, but sub-accounting builds on top of it — offering the flexibility, granularity, and automation required for dynamic environments like digital marketplaces, large-scale project finance, or real-time lending.

How Datanimbus FinHub Ledgers Powers Sub-Accounting at Scale

FinHub Ledgers is built to make sub-accounting programmable, intelligent, and effortless for your business.

Here’s what sets it apart:

- Multi-Level Ledgering: Create parent-child relationships and nested sub-ledgers for any structure you need

- Policy-Driven Controls: Define spending caps, rules, and validations that apply automatically.

- Event-Based Automation: Auto-trigger alerts, balance movements, or status changes based on financial activity

- Real-Time Tracking: View balance snapshots, usage history, and transaction summaries instantly

- Audit-Ready by Design: Every entry is traceable with context — who, why, and under what policy

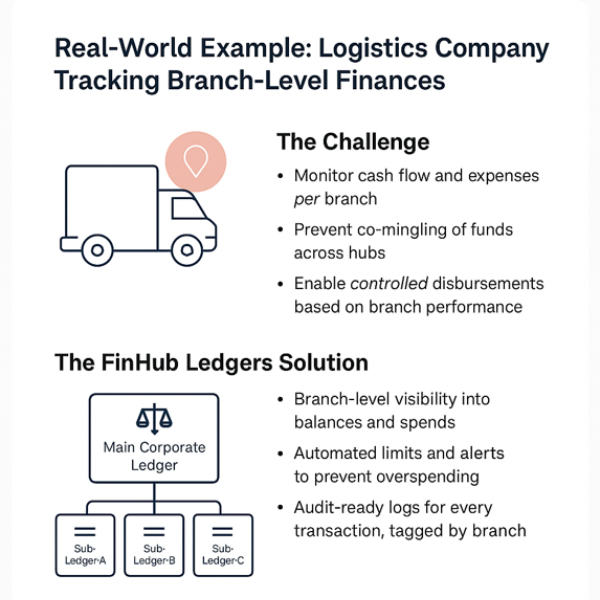

Real-World Example: Logistics Company Tracking Branch-Level Finances

A national logistics company operates hundreds of delivery hubs across the country. Each hub handles local collections, payouts to delivery partners, and operational expenses.

The Challenge

The FinHub Ledgers Solution

With DataNimbus FinHub Ledgers, the company created a single corporate ledger and set up a sub-ledger for each logistics hub.

Each sub-ledger:

- Receives funds allocated to that specific branch

- Tracks transactions like local partner payments, fuel costs, and collections

- Enforces rules like spending caps or approval thresholds

The Outcome

- Branch-level visibility into balances and spends

- Automated limits and alerts to prevent overspending

- Audit-ready logs for every transaction, tagged by branch

- No banking overhead, with everything managed from a single platform

Conclusion :

Sub-Accounting Is Strategic Financial Infrastructure

For fast-moving businesses, agility isn’t optional — it’s a competitive advantage.

Sub-accounting gives you the clarity, compliance, and control you need to scale confidently, whether you’re running a marketplace, managing escrows, disbursing loans, or orchestrating multi-department budgets.

With DataNimbus FinHub Ledgers, you don’t just track balances. You program your money flows — and manage your financial operations with speed, precision, and confidence.