- AI Platforms

Fueled by a Visual Designer, Marketplace for Reusable Connectors, ETL & ML Blocks.

Fueled by a Visual Designer, Marketplace for Reusable Connectors, ETL & ML Blocks.

Agentic AI Integrations

Integration enables agents to deliver AI outcomes faster, better, simpler.

DataNimbus FinHub

With the DataNimbus FinHub platform, we offer a whole range of escrow management.Navigate Your AI Journey

Break free from legacy! Modernize your core with intelligent, AI-powered solutions

- AI Applications

- Services

DataNimbus Consulting

- Data AI Strategy

- Data and AI Architecture

- Payment Automation

Product Engineering Services

- Product Design & UX

- Custom APIs

- AI enabled Applications

Data Analytics & AI/ML

- Data Management

- AI Applications and Models

- Custom Workflows

Enterprise Integration

- Custom API

- Process Orchestration

- Intelligent Process Orchestration Management

- Customers

- Resources

- Company

- AI Platforms

Fueled by a Visual Designer, Marketplace for Reusable Connectors, ETL & ML Blocks.

Fueled by a Visual Designer, Marketplace for Reusable Connectors, ETL & ML Blocks.

Agentic AI Integrations

Integration enables agents to deliver AI outcomes faster, better, simpler.

DataNimbus FinHub

With the DataNimbus FinHub platform, we offer a whole range of escrow management.Navigate Your AI Journey

Break free from legacy! Modernize your core with intelligent, AI-powered solutions

- AI Applications

- Services

DataNimbus Consulting

- Data AI Strategy

- Data and AI Architecture

- Payment Automation

Product Engineering Services

- Product Design & UX

- Custom APIs

- AI enabled Applications

Data Analytics & AI/ML

- Data Management

- AI Applications and Models

- Custom Workflows

Enterprise Integration

- Custom API

- Process Orchestration

- Intelligent Process Orchestration Management

- Customers

- Resources

- Company

- AI Platforms

Fueled by a Visual Designer, Marketplace for Reusable Connectors, ETL & ML Blocks.

Fueled by a Visual Designer, Marketplace for Reusable Connectors, ETL & ML Blocks.

Agentic AI Integrations

Integration enables agents to deliver AI outcomes faster, better, simpler.

DataNimbus FinHub

With the DataNimbus FinHub platform, we offer a whole range of escrow management.Navigate Your AI Journey

Break free from legacy! Modernize your core with intelligent, AI-powered solutions

- AI Applications

- Services

DataNimbus Consulting

- Data AI Strategy

- Data and AI Architecture

- Payment Automation

Product Engineering Services

- Product Design & UX

- Custom APIs

- AI enabled Applications

Data Analytics & AI/ML

- Data Management

- AI Applications and Models

- Custom Workflows

Enterprise Integration

- Custom API

- Process Orchestration

- Intelligent Process Orchestration Management

- Customers

- Resources

- Company

- AI Platforms

Fueled by a Visual Designer, Marketplace for Reusable Connectors, ETL & ML Blocks.

Fueled by a Visual Designer, Marketplace for Reusable Connectors, ETL & ML Blocks.

Agentic AI Integrations

Integration enables agents to deliver AI outcomes faster, better, simpler.

DataNimbus FinHub

With the DataNimbus FinHub platform, we offer a whole range of escrow management.Navigate Your AI Journey

Break free from legacy! Modernize your core with intelligent, AI-powered solutions

- AI Applications

- Services

DataNimbus Consulting

- Data AI Strategy

- Data and AI Architecture

- Payment Automation

Product Engineering Services

- Product Design & UX

- Custom APIs

- AI enabled Applications

Data Analytics & AI/ML

- Data Management

- AI Applications and Models

- Custom Workflows

Enterprise Integration

- Custom API

- Process Orchestration

- Intelligent Process Orchestration Management

- Customers

- Resources

- Company

Blog

Everything you need to know about Google’s Agent Payment Protocol

Introduction:

With the boom of AI and autonomous agents, we’ve already seen disruption across industries from automating engineering workflows to drafting legal contracts to handling customer support. And now, there’s a not-so-silent shift happening in the payments landscape.

Agent-led commerce is no longer a futuristic idea; it’s already here. Analysts estimate that by 2030, up to 30% of digital transactions could be initiated by AI agents rather than humans. That’s billions of payments annually happening without a human ever clicking “Buy.”.

For businesses, this is not just a technological shift—it’s a new competitive battleground. Those who adapt early will unlock new revenue streams and more efficient business models, while those who don’t risk being left behind.

October 2025 | Blog

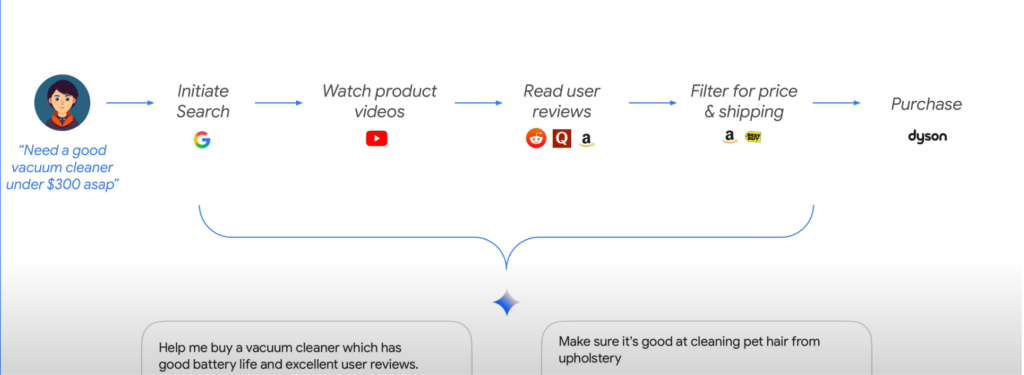

What is Agent-Led Commerce?

On the surface, this sounds futuristic and incredibly convenient. But it exposes a fundamental challenge: traditional payment flows are built on the assumption that a human is present to click “Buy” and confirm their identity. So when an agent makes a purchase on behalf of the human:

- How is it verified that the purchase was actually authorized by the user?

- If there’s fraud, who is accountable —the user, the agent provider, or the merchant?

What is AP2?

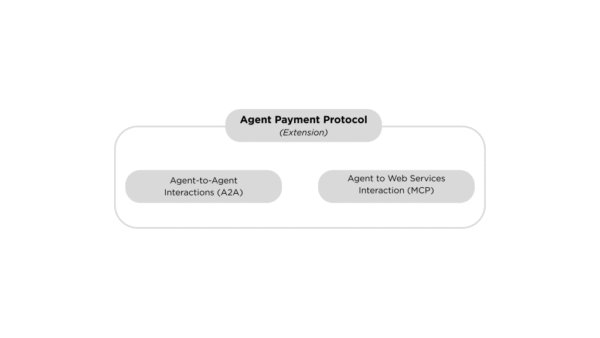

The Agent Payment Protocol can be described as a trust layer that brings authenticity, auditability, and accountability to agent-led purchases.

- It is open-source, designed for broad adoption.

- It extends the Agent-to-Agent (A2A) and Model Context Protocol (MCP) layers.

- It is payment-agnostic, meaning it can support a wide variety of payment methods, from traditional cards to modern real-time bank transfers, stablecoins, and even cryptocurrencies

Why the need for AP2?

As agent-led commerce gains momentum, AI agents are no longer just executing simple tasks; they’re making complex, multi-step decisions like comparing offers, evaluating subscriptions, and selecting providers. The problem is that today’s payments infrastructure was designed for human-initiated actions, not autonomous agents. Without a common standard, every vendor would be forced to create its own way of handling “agent authorization,” leading to fragmentation, inconsistency, and higher risks of fraud. Recognizing this gap, Google, together with more than 60 payments and technology leaders, including MasterCard, PayPal, Accenture, and American Express, introduced the Agent Payment Protocol (AP2) to bring auditability, verifiability, and trust to this new era of agent-led commerce.

It matters now because:

- New revenue streams: Businesses can enable autonomous subscriptions, pay-per-use micro-transactions, and machine-to-machine commerce.

- Operational transformation: Merchants, PSPs, and banks can safely allow AI agents to transact, reducing cart abandonment and unlocking personalized commerce at scale.

- Risk of inaction: Without adopting AP2, companies will face fragmented standards, higher fraud exposure, and slower onboarding into agent-driven ecosystems.

Core Principles of AP2

Google’s AP2 model is built on four core principles designed to addresses a specific gap in today’s payments landscape and, together, they create a framework for trust.

-

Interoperability

AP2 is designed to work seamlessly across merchants, payment service providers (PSPs), banks, and agent platforms. Today, every ecosystem has its own way of handling transactions, but agent-led commerce requires a common language. By making AP2 interoperable, Google aims to prevent fragmentation, reduce integration friction for merchants, and ensure agents can transact across multiple payment rails from credit cards to real-time bank transfers to stablecoins. -

Accountability

A major concern with agents is “who’s responsible if something goes wrong?” AP2 embeds accountability by creating a cryptographically auditable record of each transaction showing the mandate issued by the user, the intent created by the agent, and the acceptance by the merchant. This trail ensures that in the case of disputes or fraud, liability can be assigned with clarity rather than confusion. -

Control & Privacy

For agent-led commerce to succeed, users need confidence that agents won’t overspend or act outside their wishes. AP2 enables fine-grained user control over what agents are allowed to do, whether it’s a one-time purchase, a recurring subscription, or a capped budget. At the same time, it’s designed to respect user privacy, ensuring that sensitive personal or financial information isn’t exposed unnecessarily during verification. -

Verifiable Intent

Perhaps the most critical principle: AP2 ensures that agents can only act within the limits explicitly approved by the user. This is achieved through mandates — cryptographically signed instructions that bind the agent’s actions to user-defined parameters. By separating “intent” (what the user wanted) from “payment” (the actual transaction), AP2 makes it possible to verify not only that a purchase happened, but that it happened for the right reason, in the right scope, and with the right authority.

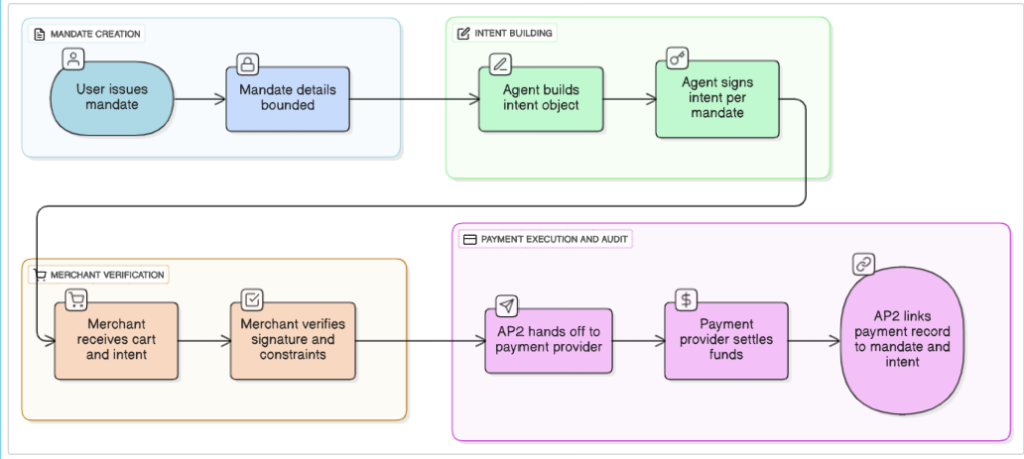

How AP2 Works: Mandates at the Core

AP2 is built around the concept of mandates. In this context, a mandate is a cryptographically signed, tamper-proof digital contract that serves as proof of trust and authorization for any agent-led transaction.

Google defines three types of mandates under AP2:

1. Cart Mandate (HP: Human-present)

A Cart Mandate is created for real-time transactions.

Example:

You ask your AI agent to find and buy a pair of shoes under $100. The agent builds a shopping cart and creates a cart mandate that specifies the product, price, and merchant. The merchant validates this mandate before processing payment.

2. Intent Mandate (HNP: Human-not-present)

An Intent Mandate is broader and created for recurring or goal-based tasks.

Example:

You authorize your agent with an intent mandate like: “Book my monthly grocery order, but keep it under $200 and ensure items are organic where possible.”

Each month, your agent uses this mandate to make purchases without needing fresh approvals every time, as long as it stays within the defined limits.

3. Payment Mandate

A Payment Mandate gives direct authority for fund disbursement, especially for subscriptions or scheduled payments.

Example:

You subscribe to a streaming service and allow your agent to auto-renew the subscription every month at $12. The payment mandate ensures the renewal happens seamlessly, while still keeping it auditable if disputes arise later.

Together, these mandates provide a layered trust framework: real-time cart approval, recurring intent authorization, and continuous payment validation.

A high-level look at the Agent Payments Protocol (AP2) workflow, showing how it secures AI-driven transactions from the user’s initial mandate to the final, auditable payment record.

The Future: A New Era of Commerce

What makes AP2 especially powerful is not just that it solves the trust gap in agent-led payments, but that it does so at the exact moment when several transformative forces are reshaping global finance. AP2 isn’t parallel to these trends—it’s the connective layer that enables them to work safely in an AI-driven economy.

-

CBDCs (Central Bank Digital Currencies)

More than 130 countries are exploring or piloting CBDCs, with estimates suggesting that by 2030, up to 20% of global retail transactions could be settled in digital currencies issued by central banks. But CBDCs raise new questions: how do you prevent misuse when machines, not humans, initiate payments? AP2 provides the verification and audit trail needed to integrate CBDCs into autonomous commerce—so an AI agent paying your bills or trading across borders does so with compliance baked in. -

Open Banking

The open banking movement is accelerating, with APIs enabling customers to share their data and initiate payments directly with third parties. By 2027, open banking is expected to underpin more than $400 billion in global transaction volume. AP2 complements this by ensuring that agents using these APIs aren’t just technically authorized but are cryptographically accountable, giving banks and merchants confidence to support agent-led flows. -

Tokenization of Assets

From stablecoins to tokenized deposits to loyalty points, tokenization is becoming a mainstream mechanism for representing and transferring value. The tokenization of real-world assets alone could reach $16 trillion by 2030. AP2 ensures agents can transact seamlessly in these ecosystems—whether it’s redeeming tokenized rewards, trading carbon credits, or handling cross-border stablecoin payments—while preserving accountability across parties. -

AI-driven Compliance & Fraud Management

As transactions scale into the billions, human oversight is impossible. Regulators are already pushing for AI-driven compliance and real-time fraud detection. AP2 strengthens this shift by creating a tamper-proof transaction trail that links user intent, agent action, and merchant acceptance. This dramatically reduces dispute resolution time and helps financial institutions meet regulatory expectations for transparency in AI-led commerce. - IoT & Machine-to-Machine Payments By 2030, there could be 50 billion IoT devices globally, many requiring autonomous payments for maintenance, data access, or resource consumption. AP2’s payment-agnostic design makes it the backbone of machine-to-machine commerce. Picture an electric vehicle negotiating charging prices with a grid operator in real-time or a factory sensor paying per second for edge computing resources—AP2 ensures every such payment is verifiable and aligned with user-approved mandates.

Conclusion

The Agent Payment Protocol is the foundation for a new era of commerce where AI agents can act as trusted intermediaries in financial transactions. By addressing the fundamental challenges of trust, accountability, and control in agent-led commerce, AP2 paves the way for innovations we can only begin to imagine.

As we stand at the threshold of this transformation, one thing is clear: the future of commerce won’t just be digital—it will be autonomous, intelligent, and built on the robust trust mechanisms that protocols like AP2 provide. The shift has already begun, and those who adapt early will be best positioned to thrive in this new landscape.